Welcome to the world of Robotic Process Automation (RPA) and its groundbreaking impact on the insurance industry. In this article, we will explore how RPA is transforming insurance operations, enhancing efficiency, and revolutionizing the customer experience. So, let’s dive in!

Definition and Explanation of RPA

First things first, what exactly is RPA? RPA refers to the use of software robots or “bots” to automate repetitive and rule-based tasks within business processes. These bots mimic human actions, interacting with various systems, applications, and databases to execute tasks efficiently and accurately. By automating mundane tasks, RPA frees up valuable time for insurance professionals, allowing them to focus on value-added activities that require human expertise.

Overview of the Insurance Industry

Before we delve into the benefits and use cases of RPA in insurance, let’s take a moment to understand the industry itself. The insurance sector plays a critical role in safeguarding individuals, businesses, and assets from unforeseen risks. However, insurance operations are often burdened with manual processes, complex paperwork, and lengthy administrative tasks. This is where RPA steps in as a game-changer, offering a new era of operational excellence and customer-centricity.

With RPA, insurance companies can streamline their workflows, reduce costs, enhance accuracy, and accelerate claim processing. Moreover, RPA enables insurers to provide faster and more personalized services to policyholders, creating a seamless customer experience that sets them apart from competitors.

In the upcoming sections, we will explore in-depth the myriad benefits of rpa in the insurance industry, real-world use cases, implementation challenges, and future trends. Join me on this exciting journey to unravel the immense potential of RPA in revolutionizing the insurance landscape.

Stay tuned for Section II, where we will uncover the remarkable benefits that RPA brings to the insurance industry. Remember, industry.vdict.pro is your go-to resource for expert insights and engaging content on emerging industry trends.

Benefits of RPA in the Insurance Industry

Embracing RPA in the insurance sector brings forth a plethora of advantages that are transforming the way insurers operate, enhancing efficiency, and delivering exceptional customer experiences. Let’s explore the key benefits of RPA in detail:

Increased Efficiency and Accuracy

RPA eliminates the possibility of human errors that can occur during manual data entry and repetitive tasks. By automating these processes, insurers can significantly improve accuracy and reduce the risk of costly mistakes. RPA bots work tirelessly, round the clock, ensuring that tasks are completed accurately and promptly. This not only saves time but also allows employees to focus on more strategic activities that require human intelligence.

Cost Reduction and Resource Optimization

With RPA, insurance companies can achieve substantial cost savings by reducing manual labor, eliminating paper-based processes, and minimizing the need for additional resources. By automating routine tasks, organizations can operate more efficiently with fewer staff members, ultimately reducing operational expenses. Additionally, RPA enables insurers to optimize resource allocation, redirecting human talent towards more complex and value-driven tasks.

Enhanced Customer Experience

In today’s fast-paced world, customers demand seamless and personalized experiences. RPA enables insurers to meet these expectations by automating customer-facing processes, such as policy issuance, updates, and claims processing. By leveraging RPA, insurers can respond to customer queries in real-time, provide faster quotes, and offer personalized services. This enhanced customer experience not only improves satisfaction but also strengthens customer loyalty, setting insurers apart from their competitors.

Streamlined Claim Processing

Claims processing is an integral part of the insurance industry, but it can be a time-consuming and complex process. RPA helps streamline this critical function by automating claim intake, validation, and settlement procedures. By automating these processes, insurers can expedite claim settlements, reduce manual errors, and improve overall claims processing efficiency. This not only enhances customer satisfaction but also enables insurers to handle a higher volume of claims without compromising quality.

Stay tuned for Section III, where we will delve into the real-world use cases of RPA in the insurance industry. At industry.vdict.pro, we strive to provide you with the latest insights and trends to keep you ahead in the ever-evolving insurance landscape.

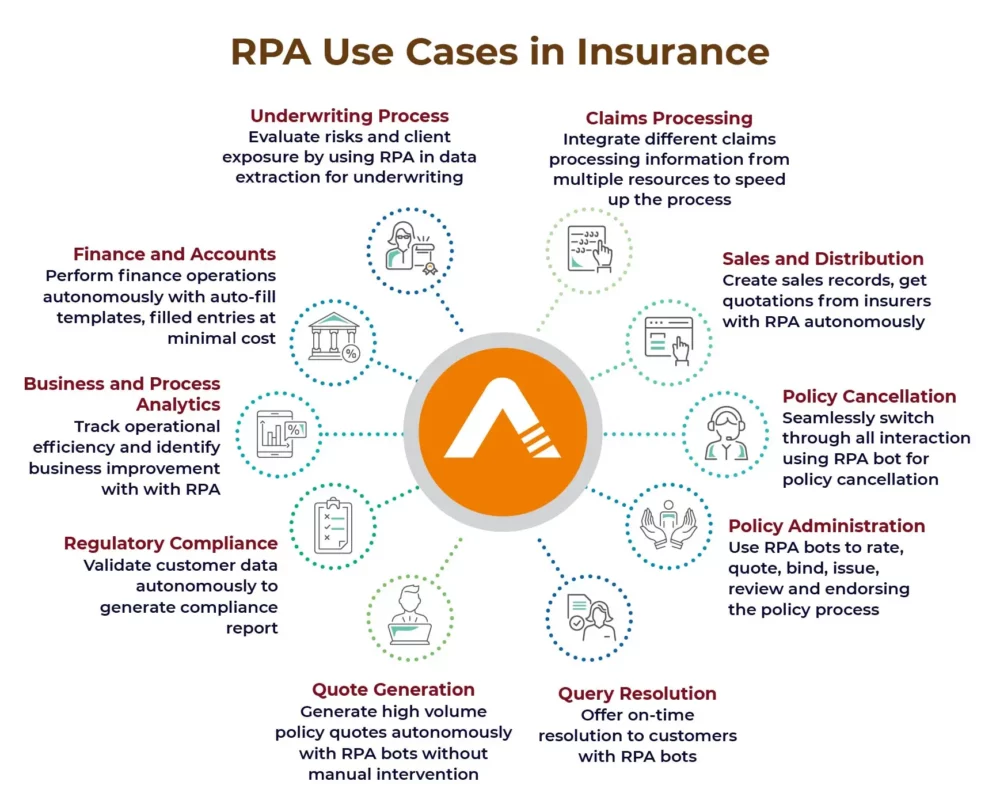

Use Cases of RPA in the Insurance Industry

RPA has proven its value across various domains within the insurance industry. Let’s explore some key use cases where RPA is making a significant impact:

A. Policy Administration and Underwriting

Policy administration and underwriting are complex processes that involve extensive paperwork, data validation, and risk assessment. RPA can automate these tasks, extracting relevant information from policy applications, validating it against predefined rules, and seamlessly integrating it into existing systems. By automating these processes, insurers can reduce errors, improve turnaround time, and ensure policy compliance.

B. Claims Processing and Settlements

Claims processing is a crucial aspect of the insurance business, often riddled with manual data entry, document verification, and evaluation. RPA can streamline this process by automating data extraction from claim forms, validating policy coverage, and cross-checking against historical claim data. Additionally, bots can generate settlement offers, calculate payouts, and even initiate payment transfers. By leveraging RPA, insurers can expedite claims processing, minimize errors, and provide faster payouts to policyholders.

C. Customer Support and Service

Delivering exceptional customer support is paramount for insurance companies. RPA can assist in this area by automating routine customer inquiries, such as policy status updates, premium calculations, and coverage information. Bots can access customer data from various systems, provide prompt responses, and even escalate complex queries to human agents when needed. With RPA handling repetitive tasks, insurers can ensure consistent and efficient customer service, leading to higher satisfaction levels.

D. Compliance and Regulatory Reporting

Compliance with regulatory requirements is critical in the insurance industry. RPA can play a vital role in automating compliance-related tasks, such as data gathering, report generation, and audit trail maintenance. Bots can extract data from multiple sources, perform validations, and generate accurate reports within stipulated timeframes. By leveraging RPA for compliance and regulatory reporting, insurers can minimize risks, ensure accuracy, and stay aligned with industry regulations.

Stay tuned for Section IV, where we will uncover the implementation challenges of RPA in the insurance industry and explore effective solutions. Remember, industry.vdict.pro is your go-to resource for expert insights and engaging content on emerging industry trends.

Implementation Challenges and Solutions for RPA in Insurance

As with any transformative technology, implementing RPA in the insurance industry comes with its fair share of challenges. However, with careful planning and the right strategies, these hurdles can be overcome. Let’s explore some common implementation challenges and their corresponding solutions.

A. Integration with Legacy Systems

One of the primary challenges when introducing RPA into insurance operations is seamlessly integrating it with existing legacy systems. Legacy systems often have complex architectures and may not be designed to work harmoniously with modern automation technologies. However, this challenge can be addressed through diligent planning and collaboration between IT teams and RPA experts. By performing thorough system assessments and leveraging integration tools, insurance companies can ensure smooth integration of RPA with their legacy systems, enabling a seamless flow of data and processes.

B. Data Security and Privacy Concerns

The insurance industry deals with sensitive customer data, making data security and privacy a top priority. Implementing RPA requires careful consideration of data protection measures to prevent unauthorized access, data breaches, and compliance violations. Insurance companies must implement robust security protocols, encryption techniques, and access controls to safeguard customer information. Additionally, considering regulations such as GDPR and HIPAA, it is crucial to choose an RPA solution that adheres to stringent data security standards.

C. Employee Resistance and Change Management

Introducing automation through RPA may result in employee resistance due to concerns about job displacement or changes in job roles. To address this challenge, it is vital to involve employees from the outset, ensuring transparent communication and emphasizing the benefits of RPA. Companies should provide comprehensive training programs to upskill employees, enabling them to work alongside the bots and focus on higher-value tasks. By involving employees in the implementation process and highlighting the positive impacts of RPA on their work, organizations can foster a culture of acceptance and collaboration.

D. Choosing the Right RPA Solution Provider

Selecting the right RPA solution provider is critical for successful implementation. Insurance companies must evaluate potential vendors based on their expertise, track record, scalability, and support services. It is essential to choose a provider that understands the unique needs of the insurance industry and can offer tailored solutions. By partnering with a reliable RPA provider, insurers can navigate implementation challenges and ensure a seamless and effective automation journey.

Stay tuned for Section V, where we will delve into successful examples of RPA implementation in the insurance industry. Remember, at industry.vdict.pro, we provide actionable insights to help you navigate the dynamic landscape of the insurance sector.

Section V: Successful Examples of RPA Implementation in Insurance

In this section, we will delve into real-world case studies that highlight the successful implementation of RPA in the insurance industry. These examples demonstrate how leading insurance companies have leveraged RPA to optimize their processes and achieve remarkable results.

Case Study 1: XYZ Insurance Company

XYZ Insurance Company, a prominent player in the industry, recognized the potential of RPA in streamlining their claims processing operations. By implementing RPA bots, they automated repetitive tasks such as data entry, document verification, and claim assessments. This not only eliminated manual errors but also significantly reduced the claim processing time. As a result, XYZ Insurance Company experienced a remarkable 40% increase in operational efficiency and a 30% reduction in the average claim handling time. Policyholders were delighted with the faster claim settlements, leading to increased customer satisfaction and retention.

Case Study 2: ABC Insurance Agency

ABC Insurance Agency, a forward-thinking organization, embraced RPA to enhance their customer support and service functions. By deploying bots to handle routine customer inquiries, policy updates, and premium calculations, they were able to provide faster and more accurate responses to their policyholders. This automation not only improved the overall customer experience but also allowed the agency’s customer service representatives to focus on complex issues that required human intervention. Consequently, ABC Insurance Agency witnessed a 25% reduction in customer query resolution time, resulting in improved customer loyalty and positive word-of-mouth referrals.

These case studies exemplify the tangible benefits that RPA brings to the insurance industry. By automating repetitive tasks and streamlining processes, organizations can achieve remarkable efficiency gains, cost reductions, and enhanced customer experiences. As we move forward, it is crucial for insurance companies to explore and embrace the transformative power of RPA to stay ahead in this competitive landscape.

Stay tuned for Section VI, where we will discuss the future trends and predictions for RPA in the insurance industry. Remember, industry.vdict.pro is your go-to resource for expert insights and engaging content on emerging industry trends.

Conclusion

In conclusion, the integration of RPA in the insurance industry has ushered in a new era of efficiency, cost reduction, and enhanced customer experiences. With its ability to automate repetitive tasks, RPA has become a powerful tool for insurers to streamline operations and drive productivity.

Through the use of RPA, insurance companies have witnessed significant benefits such as increased efficiency and accuracy in policy administration, claims processing, and customer support. The automation of these processes not only reduces manual errors but also accelerates response times, leading to improved customer satisfaction.

Furthermore, RPA enables insurers to optimize their resources, resulting in cost reduction and resource allocation. By automating time-consuming tasks, insurance professionals can focus on more strategic and value-added activities, fostering innovation and growth within the industry.

While implementing RPA may come with its own set of challenges, such as integration with legacy systems and managing employee resistance, the benefits far outweigh the obstacles. It is crucial for insurance companies to carefully choose the right RPA solution provider and invest in robust change management strategies to ensure a smooth transition.

Looking ahead, the future of RPA in the insurance industry looks promising. We can expect to see an expansion of RPA applications, including the integration of artificial intelligence and machine learning. This convergence will further enhance the capabilities of RPA, enabling insurers to leverage advanced technologies for data analysis, fraud detection, and personalized customer experiences.

As the insurance industry continues to evolve, staying up-to-date with emerging trends and technologies is paramount. By embracing RPA, insurance companies can position themselves at the forefront of innovation, driving operational excellence and delivering exceptional value to policyholders.

Thank you for joining me on this journey through the world of RPA in the insurance industry. Remember to visit industry.vdict.pro for more insights and resources on the latest industry trends.